May 2024 | 2347 words | 9-minute read

At exactly 10.00am IST on November 30, 2023, the gong was sounded at the historic trading hall of the Bombay Stock Exchange (BSE), signalling the debut of Tata Technologies on India’s stock exchanges (BSE: 544028, NSE: TATATECH).

Within minutes, the share price zoomed to Rs 1,200 on the National Stock Exchange (NSE) and Rs 1,199.05 on the BSE — at a premium of 140% higher than the issue price of Rs 500. History was made — it was one of the fastest IPOs to be fully subscribed within minutes of opening and was oversubscribed 69.43 times, with investors pouring in Rs 1.57 lakh crore through 73.4 lakh applications, the highest number of retail applications for an Indian listing till date.

For all the people present in the BSE trading hall — the leadership and teams from Tata Technologies, Tata Motors, and Tata Sons — it was an unforgettable moment, the realisation of a long-awaited dream in the company’s 35-year journey.

“The IPO was a dream come true,” says Warren Harris, Chief Executive Officer and Managing Director, Tata Technologies. “We have been working on this project for several years and there were several moments where we found ourselves close to the finish line only to realise that the target has changed. There are several employees at Tata Technologies who are also shareholders and working since inception, and that moment we got listed truly fulfilled the dream that many of us saw together.”

The Tata Technologies IPO listing represents a pivotal moment in the group’s and India’s technological evolution. It underscores the company’s position as a global powerhouse in engineering and design solutions, catering to some of the world’s leading companies across industries like automotive, aerospace, and heavy machinery. The listing is also an endorsement of India’s position as a global technology hub.

“The IPO was a dream come true.”—Warren Harris, CEO

From its beginnings as an automotive design division for Tata Motors, to a historic listing on the Indian stock exchanges, the company has come a long way.

The beginning

The story of this success began in 1989, against the backdrop of advancements in computer-aided design, engineering, and manufacturing software, collectively called CAx. They revolutionised how products were conceived, designed, built and manufactured, often resulting in a 40% improvement in quality, throughput, and cycle times. Original equipment manufacturers (OEMs) across the world adapted, as did Tata Motors. Ratan Tata, the then Chairman of Tata Sons, and currently Chairman Emeritus, Tata Sons, and Chairman, Tata Trusts, also saw an opportunity — while Asian engineering services and IT outsourcing industries possessed solid IT skills and cost advantages, they lacked the product development pedigree needed to fully exploit CAx. The situation was tailor-made for the setting up of a dedicated engineering services company. In 1994, the division was hived off as a subsidiary and named Core Software Systems. It continued to serve Tata Motors’ needs almost exclusively.

A major stimulus was the 1998 launch of the iconic Indica, India’s first indigenous passenger car. If the company could package the creative capacity, product development knowledge, and cost competitiveness of the team that had engineered and designed the Indica, and offer it to the wider industry, it could revolutionise the engineering services market. “It was a breakthrough insight and led to the origin of Tata Technologies as an independent engineering services company,” says Mr Harris.

In 2001, the company was renamed Tata Technologies. Four years later, it acquired UK-based INCAT International. This was a major turning point — INCAT was bigger and brought in marquee customers, critical capabilities, and a presence in major manufacturing hubs worldwide. Tata Technologies brought in scale, cost competitiveness, and access to high calibre Indian engineering talent. “It represented a rare instance of a truly synergistic deal,” says Mr Harris, who was then Chief Executive Officer of INCAT.

It had a considerable impact on Tata Technologies’ operating model and culture. As opposed to an India-out play, the company developed a balanced global delivery model across the value chain, differentiating it from other India-based companies. Its world-class technical and key account teams located at client bases enable intimacy and trust, a critical element in product development.

Building the auto vertical

The 2008 launch of the Nano further demonstrated the company’s potential in full product play. Having engineered two-thirds of the Nano, which is still considered a masterpiece in frugal engineering, the company proved that it could deliver on a challenging brief and bring imagination to reality. Four years later, the reveal of its electric MObility (eMO) engineering study concept EV at the 2012 North American International Auto Show, where the Tesla Model S was also unveiled, “The eMO symbolised the coming of age of Indian automotive engineering,” says Mr Harris.

“It (the eMO) was a tangible example of our capability to engineer a full vehicle — a first for any India-based engineering services company.”—Warren Harris

The eMO was made with a target price of $20,000, at a time when battery packs cost $12,000-13,000. “It was a tangible example of our capability to engineer a full vehicle — a first for any India-based engineering services company.” It put Tata Technologies at the forefront of the industry’s move to electric propulsion

Tata Motors’ acquisition of Jaguar Land Rover (JLR) in 2008 gave Tata Technologies an opportunity to demonstrate its value proposition at scale. A multi-year capability maturation programme led to it incrementally engineering several JLR vehicles. The first breakthrough came in 2014, with the Land Rover Discovery Sport, a premium subcompact SUV. A JLR executive said, “Tata Technologies engineered every part of the vehicle you can see, touch, and feel.”

“We took responsibility for most of the vehicles that were built on the steel platform at JLR throughout 2014-19; for example, the Evoque, F-PACE, and others,” says Mr Harris. By 2014, the earnings from JLR and Tata Motors — its anchor clients — contributed up to 69% of Tata Technologies’ revenue.

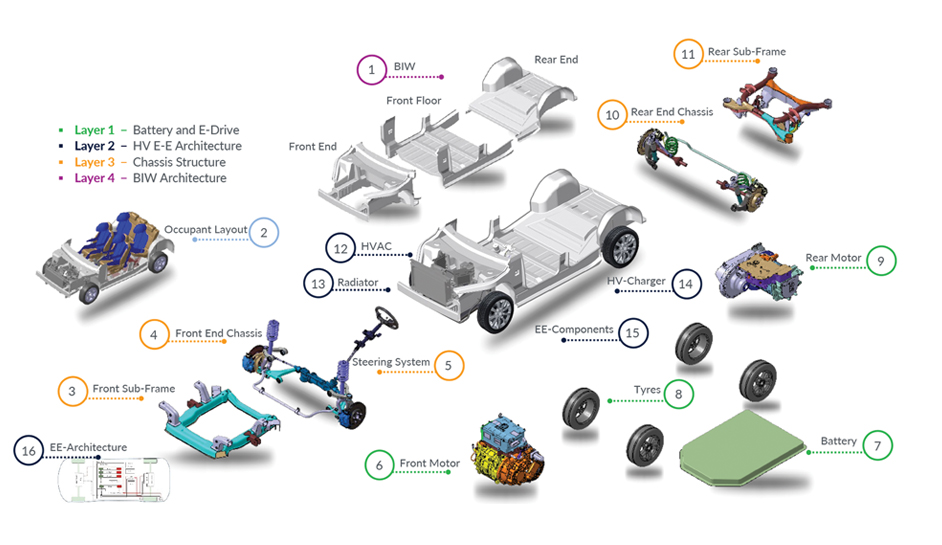

These advances were scaled up into turnkey product development offerings, the eVMP™ (electric vehicle modular platform) and Pulse NPI product development data management platform, which enabled Tata Technologies to act as an extended arm of several OEMs delivering full vehicle products — the only India-based firm to do so. The resultant intellectual property has also been licensed by several OEMs globally. A digital thread of offerings followed, including Power of 8, a digital customer life cycle management solution, and TRACE, an IoT-led connected vehicle platform for fleet management and telematics.

Project Trinity

The company considered a public offering as early as 2005-06, but kept it aside as it was felt that the engineering services market was not mature enough, and a pivot to IT services dedicated to the manufacturing industry, while attractive, was not what the company saw for itself.

The years that followed saw substantial development in the CAx sector. Product and technology advancements veered towards an ecosystem, rather than proprietary vertical integration within OEMs themselves. The industry was beginning to afford space to independent product engineering and services companies, with Tata Technologies emerging as a significant global player.

By the end of the third quarter of FY23, Tata Technologies had limited its exposure to anchor customers — down to 39% from a peak of 69% in 2014-15 — with 34 million-dollar accounts contributing towards the revenue mix. It seemed opportune to consolidate its independent status by going public. The company’s financial performance as it recovered from a Covid-induced dip — the highlight being EBITDA margins rising from 16% to 19% by December 2023, well above its global peers — also gave the board, the group, and stakeholders confidence in its ability to emerge as an independent public company.

“A few years ago, the idea was mooted in a conversation between PB Balaji [Chief Financial Officer of Tata Motors] and Tata Sons Chairman N Chandrasekaran,” says Savitha Balachandran, Chief Financial Officer, Tata Technologies. “He gave it a green signal, saying let’s pursue, let’s see how it goes.” In December 2022, the decision was formalised. Tata Motors’ IPO committee gave its in principle approval to launch the IPO.

Project Trinity was now in motion.

Diligence to debut

The preparation for an IPO came with its own complexity, with considerable work required in preparing financial statements, audit processes, and reporting, and communicating the value proposition, not only in the presentations that the leadership team would make to anchor investors, but also for the important Draft Red Herring Prospectus, as well as public announcements and communication within the company. A hand-picked team of people from several critical functions, including finance, secretarial, marketing, communications, and legal was assembled. External teams included bankers, audit and accounts, legal counsel, and registrars to the issue.

In time, the walk took over the talk as senior leadership participated in roadshows to showcase Tata Technologies’ vision, its strengths, growth prospects, and commitment to shareholder value. This resulted in a pre-IPO raise of Rs 791 crore from 67 anchor investors.

“The feeling that we were all part of something special created that momentum within the team and that’s why I say it is a team sport.”—Savitha Balachandran, CFO

The sense of energy and excitement was palpable when the entire project went mission-mode. “Everyone on the team had a day job in addition to the IPO project, which is a 24/7 job,” says Ms Balachandran. “The feeling that we were all part of something special created that momentum within the team and that’s why I say it is a team sport.”

“I cannot reinforce enough the support that we have received from the group and Tata Motors in the journey,” says Mr Harris. “The IPO benefited from the board, with the presence of people like Mr Balaji, Chairman Chandrasekaran’s sponsorship and involvement, Group CFO Saurabh Agrawal, and Ankur Verma [Group Chief Strategy Officer], as well as the legal teams, the banks, the auditors. The internal team that we were able to assemble for Project Trinity was second to none.”

“We were confident that the IPO was going to be successful, but we were surprised at how successful it was!”—Warren Harris

For Mr Harris, the debut in the markets surpassed all expectations. “We were confident that the IPO was going to be successful, but we were surprised at how successful it was!” he says.

Armed with its enduring commitment to innovation, strategic acumen, and unwavering dedication to excellence, Tata Technologies stands poised to embark on a new chapter of growth and expansion in the global marketplace.

- Haroon Bijli and Esther Cabral

Beyond the group

- In 2015, Tata Technologies’ engagement with Nio established its credibility in the automated, connected, electric and shared paradigm. It commenced at a time when Nio had no engineering division — it is now one of China’s most prominent EV makers. The collaboration resulted in the 2018 ES8, Nio’s first all-aluminium vehicle. Tata Technologies also built Nio’s complete connected car proposition on- and off-car, besides a service to support the initial firmware.

- With the launch of Volvo’s Polestar 1, a premium plug-in hybrid vehicle, Tata Technologies demonstrated its global delivery capability. It engineered the car from concept to production and launch, developing it out of Sweden, the UK, and India. The car was revealed at the 2017 Shanghai Auto Expo.

- It helped VinFast, a leading Vietnamese EV manufacturer, to develop an EV in a record time of 22 months.

Going beyond auto

While the automotive vertical has a dominant share of its deliverables (70% of revenue), Tata Technologies has long served the aerospace and industrial heavy machinery industries (10% of revenue combined) and has more recently entered the technical education and global battery pack design and integration space. It also sees opportunities in sectors where digital engineering plays a substantial part, such as high-tech and medical devices.

A large share of the heavy industry machinery business came with the 2013 acquisition of US-based Cambric Holdings. It increased Tata Technologies’ presence in Eastern Europe and offered an opportunity to provide high-end engineering services to existing and new blue-chip heavy equipment clients.

In aerospace, it has worked with clients such as British Aerospace and GKN Aerospace. In 2021, after a rigorous process, it was empanelled with Airbus as a Manufacturing, Engineering and Services Strategic Supplier. “I used to have hair before I went through that process!” jokes Mr Harris. The company expects Airbus to be among its top five customers in the next three years and the sector’s revenue contribution to increase to 25%.

Auto ER&D: A strong growth engine

OEMs around the world are transitioning to EVs and the autonomous vehicles space. The global engineering research and development (ER&D) spend is expected to grow to ~$2.67 trillion by 2026, while outsourced ER&D, $105-$110 billion in 2022, is anticipated to grow at a 11-13% CAGR. This presents a strong opportunity for Tata Technologies, which has built capabilities in these high growth areas and has been ranked first among India-based global automotive ER&D providers and third among global ER&D providers by Zinnov, an industry analyst.

“There’s a requirement for skills that many of the OEMs don’t have, and if they have those skills, they don’t have the capacity. So, it’s a tremendous opportunity for us,” says Mr Harris.

To reduce costs, OEMs are exploring ways to convert internal combustion engine (ICE) platforms to EVs. To address this need, Tata Technologies has developed an innovative ICE to EV conversion process that has reduced the launch time from 28 months to 18, reduced product development cost by 30%, and manufacturing capital expenditure by 20%.

“There’s a requirement for skills that many of the OEMs don’t have, and if they have those skills, they don’t have the capacity. So, it’s a tremendous opportunity for us,” says Mr Harris.

In 2022-23, Tata Technologies earned 88% of its revenue from automotive ER&D, and is engaged with seven of the top automotive ER&D spenders, including McLaren, Ford and Honda. Going ahead, it plans to focus on accounts with large ER&D spends as well as new energy vehicle companies.

Nurturing talent

Identifying a skill gap in the Indian engineering services industry, Tata Technologies has leveraged its domain knowledge to offer reskilling/upskilling programmes as part of its education vertical.

- It has transformed 300+ state government institutes into advanced technical skill training centres.

- Its iGetIT online training platform sees participation from 50,000+ engineers worldwide and is licensed by leading OEMs, including Tesla, Boeing, Stellantis, and Airbus.

- Tech Varsity, its phygital programme, that provides hands-on experiential learning, has helped 6,000+ engineers to reskill themselves.

Entering a new industry

With the signing of an agreement with Agratas, the Tata group’s global battery business, earlier in 2024, Tata Technologies signalled its entry into an emerging industry, which has the potential to grow exponentially. The collaboration will leverage Tata Technologies’ expertise, to help fast-track and scale Agratas’ product development and enterprise systems, and develop digital business architectures to support the design, development, and manufacturing of best-in-class battery solutions.